Starbucks teams up with Amazon to launch BIOMETRIC payment system in certain locations

05/17/2023 / By Laura Harris

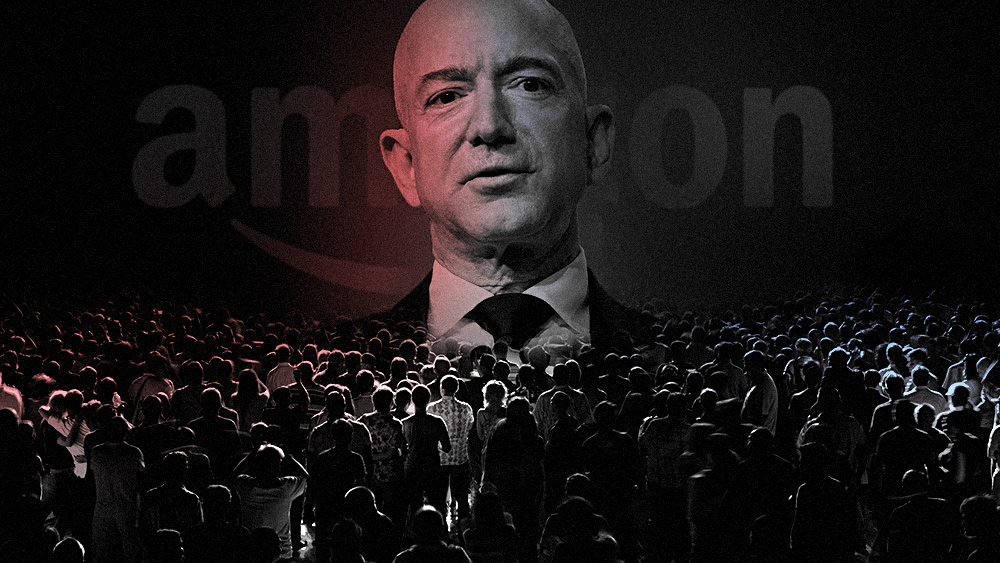

Coffee shop chain Starbucks has teamed up with tech giant Amazon to launch a biometric payment system in select locations. The system will utilize the Amazon One system that allows payments through palm scanning.

According to Reclaim the Net, the program will be launched in selected Starbucks stores in the city of Edmonds in Washington state. The pilot of the Amazon One system will serve as a bellwether to determine whether older people will embrace the new technology.

As of writing, the use of the biometric payment system at Starbucks locations remains voluntary and other payment options are still available. But reception of Amazon One has been mixed so far, with attendants reporting skepticism among older people. One attendant shared: “They’re kind of freaked out by it. It’s an older town, so some people aren’t interested.”

Those interested in using Amazon One can register their palm at an in-store kiosk. Once registered, they can then use the contactless payment system at stores with Amazon One.

Both companies defended the value of biometric payments amid customers’ concerns regarding privacy and security. Starbucks claimed the technology will provide a more convenient and secure payment experience for customers. Amazon agreed with its partner’s remarks, adding that it uses “multiple security controls” to protect customers’ data and that palm images are encrypted and stored in a “highly secure” cloud.

Big corporations backing biometric payment systems

The pilot at Starbucks locations at Edmonds is not the first time the coffee chain partnered with the Big Tech firm to experiment with new payment technologies. Starbucks had already tried Amazon Go – a checkout-free shopping experience – at concept stores in New York City.

Similarly, this was not Starbucks’ first foray into going cashless. Business Insider reported back in January 2018 that the coffee shop chain opened a cashless pilot store in the lobby of a Seattle-based office building. The endeavor sought to “evaluate customer response and garner employee feedback.”

A video published on May 7 by Reclaim the Net expounded on cashless payments and the corporations pushing them. It alleged that many companies – including JPMorgan Chase, Amazon, Microsoft and Google – are seeking to normalize biometric payments using the face and palm to harvest customers’ personal data. (Related: Identity theft using selfies: Your fingerprint can now be stolen from your pictures.)

In recent years, there has been a growing trend toward cashless payments, with more and more people turning to contactless payment methods. Advocates of biometric payment systems argue that these methods are more convenient and efficient than traditional payment methods. Moreover, they also claim these could help reduce fraud and improve financial security.

Privacy experts note, however, that biometric payment systems are not to be taken lightly. Biometric data like fingerprints, iris patterns and facial structures are inherently unique and unchangeable.

Once biometric data is collected, it can be used for a variety of purposes beyond verifying payments – such as tracking individuals, identifying them in public spaces and even profiling them for marketing purposes. If this biometric information falls into the wrong hands, individuals may be subjected to potential threats.

Head over to PrivacyWatch.news for more stories about the risks of biometric payment methods.

Watch this video that touches on biometrics and the Mark of the Beast agenda.

This video is available on God is the boss channel on Brighteon.com.

More related stories:

MasterCard tests Orwellian national ID card on Nigeria.

Security alert: Voice impersonators can trick voice recognition systems, according to research.

Biometric technology to conduct traveler identity verifications at airports.

Canada intensifies airport surveillance with digital identity and facial recognition systems.

Sources include:

Submit a correction >>

Tagged Under:

Amazon, Amazon One, Amazon.go, Big Tech, biometric data, biometric payment, Bubble, business, cashless payment, computing, contactless payment, cyber war, data privacy, data security, Glitch, information technology, money supply, payment system, privacy watch, risk, Starbucks, surveillance, technology

This article may contain statements that reflect the opinion of the author

RECENT NEWS & ARTICLES

COPYRIGHT © 2017 JEFF BEZOS WATCH